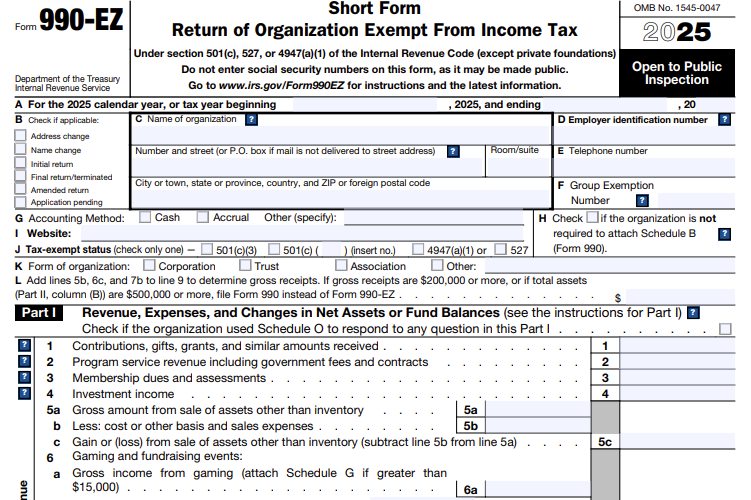

Information required for filing 990-EZ

To file your form 990-EZ, you must have the following information.

- Organization’s Name, Address, Employer Identification Number (EIN), and Telephone number

- Financial information such as Revenue, Expenses, Net Assets, and Liabilitiese

- Activities such as Program services, Lobbying, Political activities, and more

- Officer compensation, Directors, Trustees, and other organization members

- Other details such as Unrelated business income, changes made to governing documents, and more.

Visit https://www.tax990.com/form-990-ez-filing-instructions/ to learn more about Form 990-EZ filing instructions.

Why should you e-file Form 990-EZ with file990ez.com?

Interview Style or Direct Form Entry Filing Process

Includes free 990 schedules

Instant Notifications on

IRS Filing Status

Invite Users to Manage, Review and Approve your Return

Expert Chat, Email, and

Phone Support

Internal Audit Check to

eliminate errors

Re-transmit rejected

returns for free

Supports extension form 8868

and amendments

How to File Form 990-EZ Electronically?

To file Form 990-EZ electronically, visit file990ez.com & follow the steps below to

complete your filing:

- Step 1 : Search for your Organization’s EIN to import details from the IRS database or add them manually.

- Step 2 : Choose Form 990-EZ and the tax year for which you need to file

- Step 3 : Start filling out your form 990-EZ either using the Interview Style or Direct Form Entry process

- Step 4 : Our system will review your form for any IRS business rule errors. Fix the errors found, if any.

- Step 5 : Review your Form 990-EZ and Transmit it to the IRS

Ready to File Form 990-EZ Electronically for the 2025 Tax Year?

See what our clients love about Tax 990

See what our clients love about

Tax 990

Pricing to E-file Form 990-EZ

- Includes Free 990 Schedules

- No Subscription Fee

- Discounted Pricing for Tax Professionals

- Live support via chat, mail and phone.

Helpful Resources for IRS Form 990-EZ

Contact Us

If you need any assistance while requesting File Form 990-EZ, contact our awesome US-based support team.